Pittsburgh Financial Empowerment Center (FEC)

FEC expands services, reaching more residents than ever

Pittsburgh Financial Empowerment Center (FEC)

FEC expands services, reaching more residents than ever

Since 2019, the FEC has helped 1,860 clients in 6,280 sessions achieve 2,900 measurable outcomes, including $2.3 million in savings and reduction in debt by $4.2 million.

We launched the Pittsburgh Financial Empowerment Center (FEC) in partnership with the City of Pittsburgh in 2019 with the goal of providing free, one-on-one financial counseling to Pittsburghers to help increase savings, reduce debt, and improve credit. Since then, Neighborhood Allies has led efforts to help the FEC grow, evolve, and expand to reach more residents with the right type of resources and support.

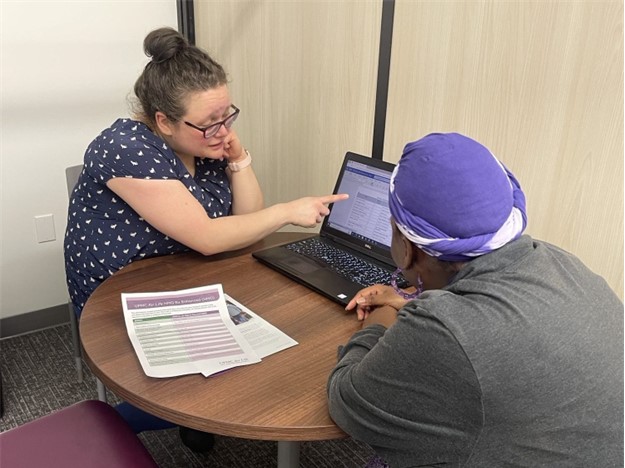

The power of the FEC lies in the trusted relationship between each client and their counselor – each of whom is trained and certified. We have a racially diverse team with in-house expertise in topics such as student loan debt and homeownership. One recent client who was able to eliminate her debt and purchase a car said, “Your help has changed my life; I am so grateful.” In response to the 2020 pandemic, we hired a fifth counselor. After adjusting to completely virtual appointments for the next two years, we actually saw the number of sessions go up due to both increased demand for services and the convenience of phone and video sessions. In mid-2022, counselors returned to in-person sessions at ten partner agencies, while retaining the virtual counseling option.

This year with our partners, the Urban Redevelopment Authority of Pittsburgh, and the national nonprofit Cities for Financial Empowerment Fund (CFE Fund), we launched Small Business Boost, a pilot program that connects small business owners and entrepreneurs to FEC counseling. In 2022, the FEC increased the total number of residents served in 2022 by 24%, producing over 700 positive financial outcomes for residents. Included in this are 112 entrepreneurs referred through this partnership for assistance in saving and credit building to prepare for small business loans.

In all, 119 social service organizations refer their clients to the FEC. These agencies understand how financial counseling complements their offerings. For example, ACTION-Housing refers select recipients of the County’s emergency rental assistance to the FEC to help with housing stabilization. Other agencies that provide homebuying counseling send clients to the FEC first to increase savings balances and credit scores.